Coinbase and Conviction, Microsoft Buys Nuance, Intel Commits to Mobileye + More

Coinbase joined the public markets this week in a direct listing. It's a big moment for cryptocurrency, because that's Coinbase's business: it helps people and institutions buy, sell and securely hold onto Bitcoin, Ethereum and a lot of other crypto assets. Its vision, though, is much bigger. As CEO Brian Armstrong says in his founder letter:

"... Cryptocurrency could provide the core tenets of economic freedom to anyone: property rights, sound money, free trade, and the ability to work how and where they want."

Before the start of trade Friday morning, the market cap of Coinbase was $85 billion.

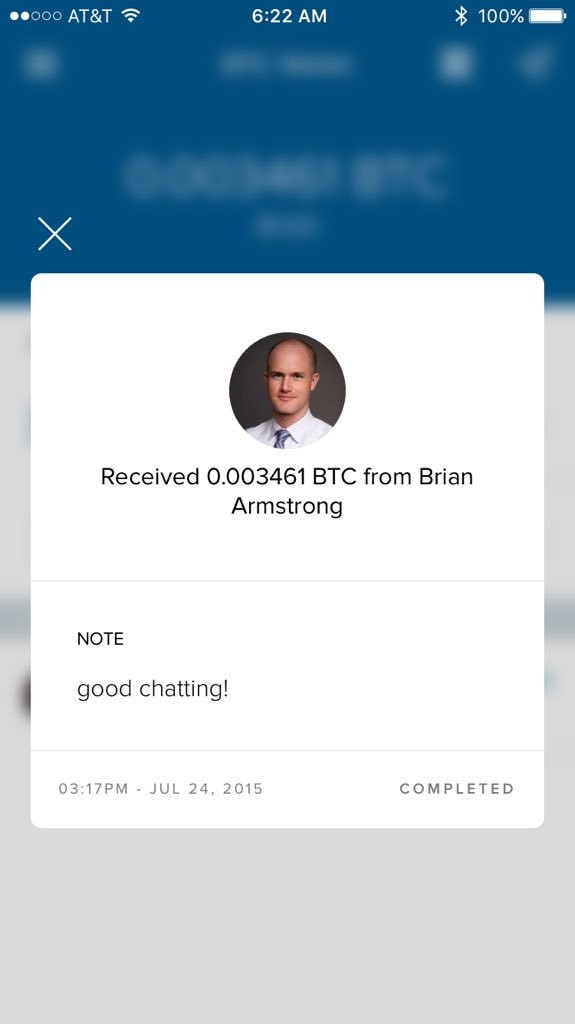

The milestone takes me back to when I met CEO Brian Armstrong: July 24, 2015. I was in San Francisco for a few days for work, and someone suggested I meet this startup founder for coffee. I'd heard of Bitcoin, but hadn't taken it seriously. My first impression of Armstrong: He was very serious. He might have been wearing a tie. Bitcoin was the future, he told me. He felt certain it would increase in value. (Back then Bitcoins were going for around $300 each.) He told me he had been taking his entire salary in Bitcoin, and wasn't cashing it out.

Risky, I thought. But the guy's got conviction.

He wanted to show me how Coinbase worked — how easy it was. So he sent $.99 to me as a way of starting my wallet in Coinbase. I set up the account, and decided to hold onto that $.99, through the ups and downs, as a way to track the progress of Bitcoin, and Coinbase.

As a journalist at CNBC, I can't own individual stocks, to avoid the appearance of a conflict of interest. (The sole exception is shares of my employer, Comcast.) I could own cryptocurrency, but I decided to stay away from it. It was sure to be a story in the coming years, as believers like Armstrong went head to head with skeptics in the establishment. I might be tempted to cover it differently if I had significant skin in the game. But I'd keep the $.99, I figured. If it doubled or tripled or dropped by half, it would at least serve as a marker of that first time I started thinking about Bitcoin as a serious startup story.

Well, here's that $.99 nearly six years later (as of Friday morning, 4/16/21). Armstrong is a billionaire on paper from his Coinbase stock alone; if he kept taking his salary in Bitcoin and not selling it for most of those years, he's probably doing well in that department, too.

The lesson: Don't underestimate an entrepreneur with conviction. And that's why the theme of the week is Conviction Buy.

Coinbase: Is the Stock Worth It? On the Other Hand

Coinbase had a $85 billion market cap after its first day of trade. Is it the future, or should investors beware? I argued both sides in the return of On the Other Hand, on CNBC's Squawk Box:

+

Satya Nadella: Microsoft to Buy Nuance to Fuel AI and Healthcare Push

The first day of our new TechCheck show on CNBC got a nice gift when Microsoft announced plans to buy Nuance. I talked to Microsoft CEO Satya Nadella and Nuance CEO Mark Benjamin about the deal:

+

Pat Gelsinger: Intel's Route is Fixed with Mobileye

I also connected with Intel CEO Pat Gelsinger ahead of a White House meeting this week on the state of semiconductor supply. Intel's AI-driven Mobileye unit, which has technology for autonomous driving, came up, too. Since Gelsinger is talking a lot about getting Intel back on track in chip development and spinning up a real foundry business, I wondered whether Mobileye is still a strategic fit for the company. He gave me an unequivocal yes:

+

Amit Walia: Multicloud is the Future

This week Informatica unveiled its Intelligent Data Management Cloud. I talked to CEO Amit Walia about the root reason why companies are using multiple clouds rather than zero in on one dominant provider:

+

Barbara Humpton: Navigating Career Upheaval

"Keep three points on the rock." Barbara Humpton is CEO of Siemens USA, an industrial technology giant playing a significant role in the global recovery. But her career has seen turbulence. In a recent Fortt Knox conversation, she shared a philosophy for navigating risky moves:

+

Fortt Knox on TechCheck: Early Experiences Shape Leaders

We've launched a new era for tech coverage on CNBC with TechCheck. How's it different from Squawk Alley? Expect a more authoritative take on what's most important in tech each day, sharper analysis and more of a spotlight on digital-first programming like Fortt Knox. Here's a piece the TechCheck team put together based on insights from Career Karma Co-founder and CEO Ruben Harris, Kabbage co-founder Kathryn Petralia, Visible CEO Miguel Quiroga and Informatica CEO Amit Walia:

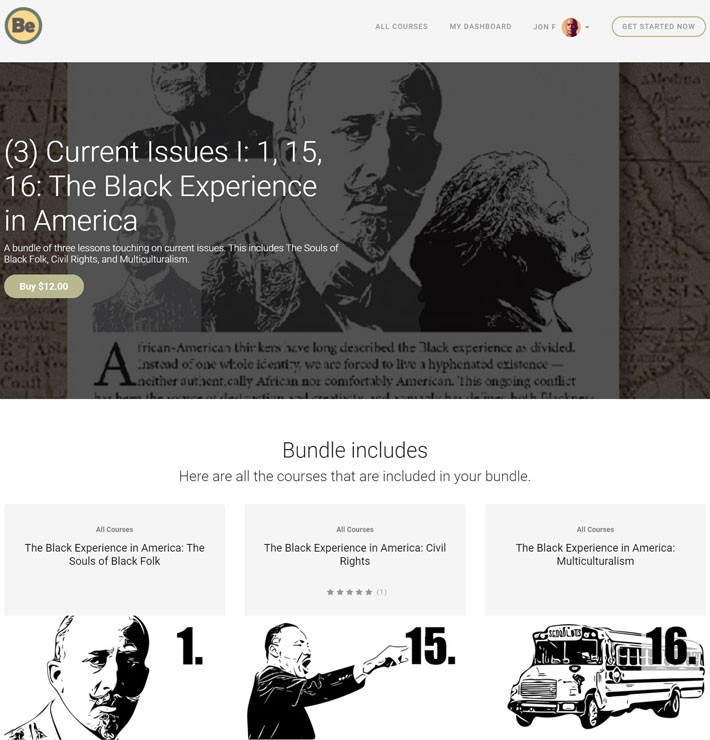

Many readers of this newsletter will be familiar by now with my latest project: The Black Experience in America: The Course. I designed it last year after the tragic killing of George Floyd, and I'm building out an online learning experience based on the content.

The students and alumni of my alma mater, DePauw University, gained access to the course material last month. I'm looking forward to more collaborations that lead us to a deeper understanding of this moment in history, the ideas that got us here and the work to move forward.