Apple vs. Facebook Stock, Halfway Through 2021

Your daily head start in the business of tech + filtered + focused

The most important thing in tech today is …

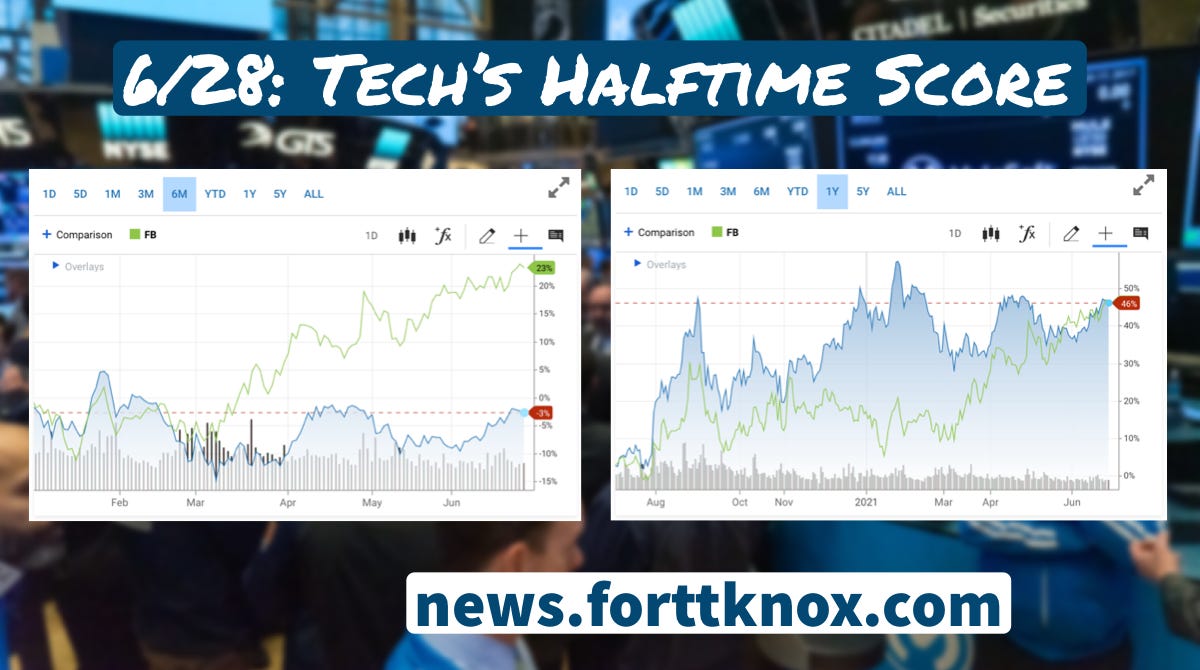

At the halfway mark of the year, it appears that Facebook is outperforming Apple; the first chart above shows Facebook up 23% over the last six months, and Apple down 3%. (Apple is the blue line, Facebook is green.)

That’s not the whole story, though.

Widen the aperture another six months, and we see in the second chart that in the 12 months since the end of June 2020 — when the strength of the economic rebound was becoming clear — Apple and Facebook are up almost exactly the same amount, nearly 50%.

What does it mean?

To me, it’s first a reminder to be careful about judging stock performance over arbitrary date ranges. Second, it’s a nod to the fact that stocks like Facebook and Alphabet (Google), which didn’t do as well as Apple in 2020, are partly just catching up. And third, it’s a call to focus again on the technologies and platforms that differentiate these companies in the first place.

In the case of Apple and Facebook:

Apple is in one of the strongest strategic positions I can remember, transitioning its iPhone lineup to 5G, and its Mac lineup from Intel chips to its own processor designs. These transitions take years to plan, and the company’s happening to do it at a moment when the pandemic has reminded the global consumer audience of the importance of smartphones as life enhancers and personal computers as productivity drivers. The company is uniquely positioned to tell its story, with hundreds of physical retail stores in ideal locations. The key question: Can Apple squeeze enough performance and margin benefit out of its vertical integration strategy to send profits higher? Or will Intel and Qualcomm come surging back?

Facebook has cemented its place as the only relevant global social network. It’s worth just shy of a trillion dollars; Snap is just over $100 billion and Twitter $55 billion. Its properties are already as essential part of the global e-commerce engine, providing tools businesses use to find and engage customers. As retail and brands emerge from the pandemic, they’re likely to lean on these digital tools more than ever to bridge physical and digital shopping experiences. The key question: As Amazon tries to vertically integrate advertising and shopping, while Shopify and others grow horizontally, will Facebook’s social stronghold be more relevant, or less?

While you were sleeping …

It’s Europe’s fourth big investigation into Google, and this time video-sharing site YouTube seems to be getting some special attention. The European Commission, the EU’s executive arm, announced last week that it had concerns that Google is favoring its own online display ad technology services, therefore potentially breaching antitrust rules in the EU. CNBC

Binance, the world's biggest cryptocurrency exchange, has been banned by the UK's financial regulator. The Financial Conduct Authority (FCA) has ruled that the firm cannot conduct any “regulated activity” in the UK. BBC

In the broader world …

U.S. Senator Rob Portman, R-Ohio, said Sunday that the bipartisan infrastructure deal can move forward, following President Joe Biden’s clarification that he’ll sign the bill even if it comes without a reconciliation package. CNBC

Head of Number 2 Pension Fund Says Managers Rarely Added Value Above Fees: “I think alpha is expensive, it’s hard to find, but they price it too high. And so the net even over a year, three years, five years, even a 10-year time period, we seldom saw managers consistently add value net of fees.” CNBC

On the horizon …

6/30: Fortt Knox 1:1 with Signifyd CEO Raj Ramanand, 1:30 p.m. ET