6/15: Ride Hailing’s Bait and Switch

The most important thing in tech today is …

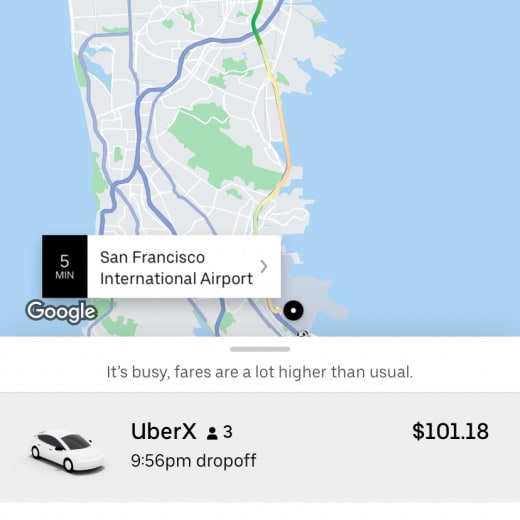

Ride hailing’s bait and switch. Remember when Ubers were both beautiful and cheap? That was about 10 years ago, when the gig world was new. Now, as the economy opens up and ride hailing companies Uber and Lyft are public companies chasing profitability, the view has changed. Today it’s like your college roommate is picking you up from the airport, and charging you double.

I remember when Uber first came out. It was amazing. I was living in Silicon Valley at the time, and had spent a couple of years working in San Francisco’s Financial District, and getting a cab there was a crummy experience in just about every way. Along comes Uber. Black cars you can summon with your phone. And the rates weren’t any more than you’d pay for a cab. Well, I was neither surprised nor sympathetic when Uber and copycats started wiping out the establishment taxi operators. But now it’s more complicated. Stories on the subject say the driver shortage is the reason for the fare hike. But they also say drivers aren’t getting big bucks from the fare hike, because Uber switched to a time and distance method for calculating driver pay. Why is this so important? Now that Uber and Lyft are public companies and not subsidized by venture capital dollars, they’re less eager to lose money on cheap fares, since shareholders want to see progress toward profits. And now that food delivery has become a steady revenue contributor, the companies don’t have to give as many bonuses to drivers and discounts to riders to hit their numbers. What will this do to the growth of the companies and the gig ecosystem? And what about how we got here? VC dollars subsidized the destruction of the taxi business, and helped replace it with a system that’s more expensive for riders and less lucrative for drivers than it first appeared. My guess is it will push the companies to be more efficient. In an above-board way, of course. Not like The Onion is suggesting:

Ha! Vulgar, but funny. But seriously …

Coming up today on CNBC’s TechCheck, 11 a.m. ET / 8 a.m. PT …

Thumbtack CEO Marco Zappacosta, Luminar Co-Founder & CEO Austin Russell, Sequoia Partner Shaun Maguire.

While you were sleeping …

Stock market futures aren’t doing much ahead of the Fed meeting.

Amazon’s cashierless Just Walk Out technology is coming to a full-size grocery store for the first time, the company has announced. The Verge

New data shows the NFT hype is fading. Overall sales plunged from a seven-day peak of $176 million on May 9, to just $8.7 million on June 15, according to numbers from Nonfungible. That means volumes are now roughly back where they were at the start of 2021. CNBC

Razer makes first E3 keynote appearance, talks to Dean Takahashi: GamesBeat

In the broader world …

A full rundown of what to expect from the Federal Reserve on Wednesday: CNBC

H&M's sales jumped from March to May compared to a year earlier as pandemic restrictions eased in many markets and online demand stayed strong but revenue was still well below 2019 levels. Reuters

Managers hoping to lure employees into offices may find their youngest and newest staff are their strongest allies. Bloomberg

On the horizon …

6/16: CNBC Evolve Summit. I’m interviewing Intel CEO Pat Gelsinger and incoming Qualcomm CEO Cristiano Amon. Register: