Crypto and Passing the Sniff Test: CEOs of Chainalysis, Metafy, Verra Mobility +More

Josh Fabian of Metafy, David Roberts of Verra Mobility, John Chen of BlackBerry

In a moment, a few words about the state of the crypto economy. But first, a few about the leaders I’ve been learning from lately:

This is the first newsletter in a couple of weeks because I’ve been running around like crazy. At the end of October, I was in Washington, D.C. for the annual conference of the National Summer Learning Association, a non-profit where I’m on the board of directors. I interviewed Secretary of Education Miguel Cardona and Secretary of Labor Marty Walsh on stage there. Then I went to my alma mater, DePauw University, for a multi-day board of trustees meeting in Indiana.

At the same time I’ve been interviewing a diverse collection of CEOs across tech, including Verra Mobility’s David Roberts, Metafy’s Josh Fabian and BlackBerry’s John Chen. I also interviewed Federal Communications Commission Chairwoman Jessica Rosenworcel last week at the Paley Center in New York. You can see some of those interviews here.

Now, about crypto:

Back in September, several news outlets were hailing Sam Bankman-Fried as the white knight of the cryptocurrency ecosystem when he offered to bail out Voyager Digital. Something about it didn’t smell right to me, and I tweeted:

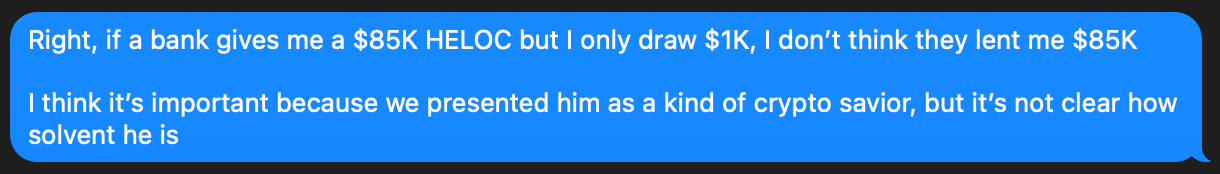

My skepticism had been growing. A story over the summer noted that Bankman-Fried’s Alameda Research owed $370 million to Voyager. Meanwhile, Alameda was offering Voyager a line of credit it barely had tapped? I texted a colleague:

My doubts weren’t limited to Bankman-Fried. I wasn’t anti-crypto, but it was fair to call me a crypto skeptic. I’ll give you couple of examples of why.

One: No one has ever been able to explain to me why the price of Bitcoin goes up and down, other than the possibility that it’s a purely speculative asset. When the masses get excited about it, they buy and the price goes up. When people get scared that the price might go down, they sell and the price goes down. That’s different from things like real estate and stocks. Yes, the price of a house can go up and down based on speculation, but there are also other things that matter, like the health of nearby employers, the quality of schools and the beauty of the region. Similarly with stocks, speculation can swing them this way and that, but it’s generally understood that stock ownership is buying a share of the underlying company’s future profits. The bigger and more profitable the company gets, the more likely the stock is to go up.

Two: Even Bitcoin, the best-known cryptocurrency, lacks practical uses. It isn’t yet good for buying things I need to buy; dollars and credit cards are much better for that. Some have argued that gold also lacks practical uses, but it has held a global reputation as a store of value for thousands of years, and in my mind it’s too soon to conclude Bitcoin has become an equivalent.

None of that led me to take a staunch anti-Bitcoin or anti-crypto position. But it did lead me to a few conclusions.

I’m not buying any crypto as long as I don’t understand what makes the price move.

The more the crypto crowd attacks skeptics for not buying in, without answering the concerns I noted above, the more entrenched my skepticism will become.

I’m wary of crypto-celebrities the way I’m wary of people at the top of a multilevel marketing organization. If this is a purely speculative asset, they have huge incentive to keep manufacturing belief.

All that said, I haven’t stayed away from the crypto ecosystem entirely. Back in May, I interviewed Chainalysis cofounder and CEO Michael Gronager for my Fortt Knox series. I did that interview because it makes sense to me that there will be a market for compliance and forensic analysis in crypto regardless of the price of any individual cryptocurrency, and Chainalysis does that for the crypto universe.

I’ve tended to avoid crypto coverage otherwise, especially as some started touting it (near the recent peak of the mania) as an avenue for traditionally marginalized groups to build wealth. That sounded too much like the multilevel marketing come-ons I’d seen people suckered by when I was growing up.

What’s next for crypto? I’m still staying away for the reasons above. But I also remain open to learning. These days it looks like Bitcoin and other cryptocurrencies are trading like highly speculative assets and could easily fall further. And it looks like crypto-celebrities — Sam Bankman-Fried is just the latest example — are still scrambling to manufacture belief in the crypto ecosystem and paint each new scandal as an isolated incident, to keep that fall from happening.